Download a PDF copy of the Lighthouse Wealth Management: Outlook – January 2024

Financial Market Review

After losing 3.3% in Q3, the S&P 500 Index rallied 11.7% in the final quarter of 2023. For the year, the Index gained 26.3%, thanks largely to a massive rally in the “Magnificent Seven” stocks: Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms and Tesla. Representing more than a quarter of the S&P 500, the Seven more than doubled as a group and drove nearly two-thirds of the Index’s return.

The tech-heavy Nasdaq 100 Composite Index was up 55% in 2023, its best year since the peak of the dotcom bubble in 1999. Sectors dominated by the Seven—Communications (53%), Technology (56%) and Consumer Discretionary (40%)—were the biggest winners. Three sectors posted negative returns: Energy (-0.6%), Consumer Staples (-0.8%) and Utilities (-7.2%).

While they didn’t fare as well as large cap stocks, small- and mid-cap shares also enjoyed double-digit returns. The Russell 2000 was up 16.8% in 2023. As with large caps, U.S. mid- and small-cap growth companies bested their value sector counterparts for the year.

Developed International stocks were up 18.4%, much better than Emerging Markets (9.0%). Non-U.S. shares were generally boosted by favorable currency effects, as most major currencies appreciated versus the U.S. dollar (USD) in 2023. The Japanese yen and Chinese yuan were notable exceptions, losing 7.1% and 2.6%, respectively, versus the USD.

Bond prices dramatically declined early in Q4, as the yield on 10-year Treasury notes reached a 16-year high (over 5%). Bonds then rallied strongly in November and were further boosted by dovish Federal Reserve language in December. The Bloomberg Aggregate Bond Index returned 6.8% for the quarter and 5.5% for all of 2023.

Commodity prices were broadly down in 2023. The Bloomberg’s Commodity Index dropped 7.9%. West Texas Intermediate (WTI) crude oil fell nearly 11%, its first negative calendar year since 2020. Gold climbed 14.6% in 2023, reaching a new all-time high in December.

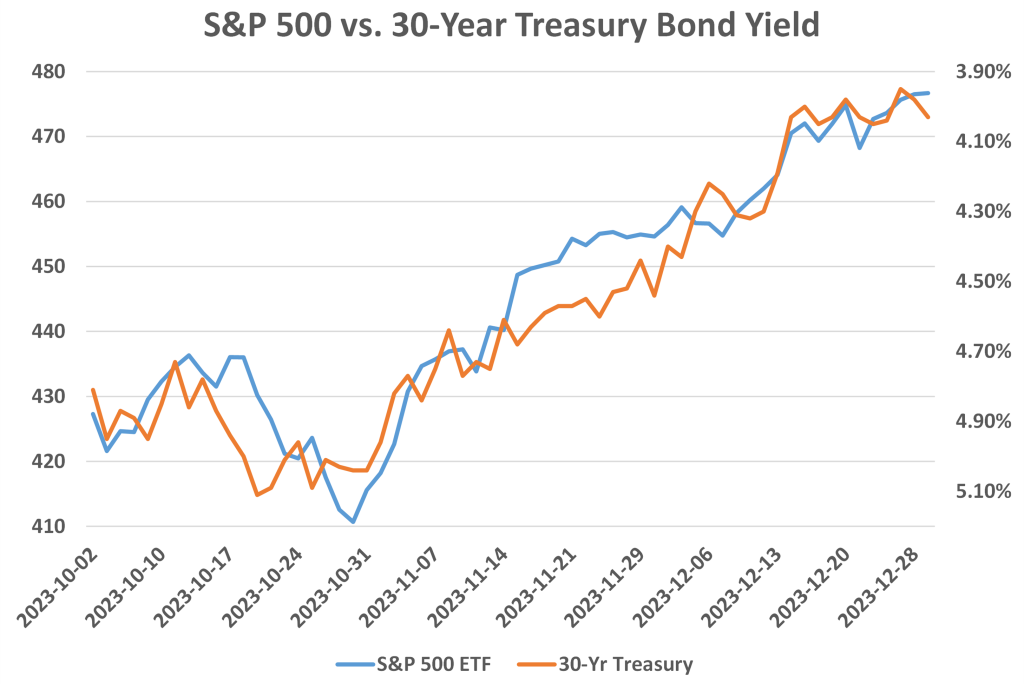

The year-end “everything rally” was driven by investors quickly adjusting expectations from a “higher-for-longer” interest rate environment to a “soft landing,” due to cooling inflation numbers and dovish Fed comments. Since October, 30-year Treasury prices and the S&P 500 have moved in near-perfect lockstep, i.e., as bond yields fell, stocks rose.

Source: YCharts

The exuberance of an “expected-easy-Fed”-driven stock rally stands in marked contrast to recent earnings projections and the tone of Q3 earnings calls. According to FactSet, fourth quarter profits are projected to have risen only 1.3% versus Q4 2022. For all of 2023, Wall Street expects earnings grew only 0.8% from 2022. Bloomberg analysis of earnings call transcripts notes that “weak demand” was among the top trending phrases for companies in the S&P 500 and the Stoxx Europe 600 benchmarks.

Economic Conditions

Real gross domestic product (GDP) growth was 5.2% annualized in Q3—the largest advance since Q4 2021. The growth came amidst decreasing inflation rates. The Consumer Price Index (CPI) increased 3.4% in December on a year-over-year basis. Core CPI rose 3.9% in December, down from 4.4% in August. Despite its decreasing pace, core inflation remains north of the Fed’s 2% target.

The job market remains strong. December job growth was 216,000, well above the 175,000 estimate. The national unemployment rate is only 3.7%, with 1.6 open jobs for every one person out of work. Average hourly earnings rose 4.1% in November on a year-over-year basis.

For its third consecutive policy meeting, the Federal Open Market Committee (FOMC) kept its target overnight federal funds rate unchanged at 5.25% to 5.50% in December. Although this was largely expected by investors, the Fed’s “dot plot” signaling three 0.25% rate cuts in 2024 was unanticipated. In short order, the “higher-for-longer” interest rate narrative shifted to a market that is now expecting six rate cuts (totaling 1.5%) in 2024.

Federal Reserve Chairman Jay Powell noted that 2023’s economic expansion was a “surprise to just about everybody.” Given that borrowing costs for businesses and consumers are at their highest levels in a decade and a half, Powell was one among millions who thought that the transmission effects would be felt sooner and more sharply than in past business cycles.

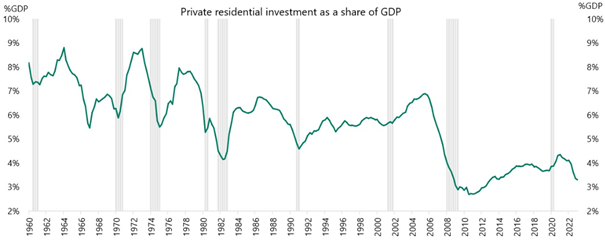

So why are interest rates taking so long to work this time around? One reason is that housing construction, a very interest-rate-sensitive sector, was already near all-time low levels as a percentage of GDP. That is, any decline in housing construction can’t reduce GDP growth very much, given that the level of residential investment is already low.

Source: Apollo Chief Economist

Asset Class & Sector Survey

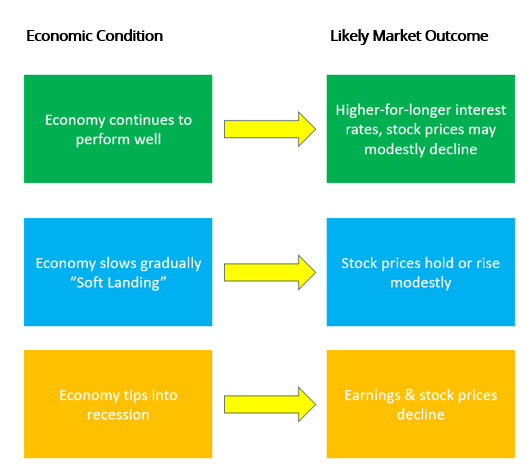

Given that core inflation is still 2% above the Fed’s target level, and that real GDP and nominal wage growth (4%) are quite robust, there’s little reason for the Fed to meaningfully alter its policy in the short term. Although its recent language is marginally dovish, the Fed’s meeting minutes are not supportive of six rate cuts this year. In so many words, it appears that stock and bond markets have gotten well ahead of themselves.

After thirteen years of sporadic quantitative easing episodes—i.e., substantial asset purchases by the Federal Reserve—investors can reasonably be forgiven for an instinctive reaction to purchase stocks at the first sign of a Fed hint that monetary conditions will soon be easing. But there’s a drawback. In fact, there are two drawbacks.

If, as the market is pricing, the Fed does cut rates by 1.5% within 12 months, the likely implication is that unemployment has meaningfully risen, along with a recession and sagging corporate earnings. During the nine instances since 1970 when the Fed has significantly reduced short-term rates, the average maximum decrease in stock prices from the start of each rate reduction period was more than 27%. In so many words, Fed pivots are historically bearish, not bullish, stock market indicators.

Alternatively, if employment remains robust and inflation remains above target, the Fed may only cut rates three times (or less). Consequently, a resumption of the “higher-for-longer” interest rate regime would probably impel markets to reprice stocks downward. Given that S&P 500 stocks are richly priced at 22 times forward earnings, there’s meaningful room for a correction.

Investors looking to “buy insurance” against a stock market correction by owning bonds have a problem, namely: the correlation between stocks and investment-grade bonds is at its highest level in forty years. To continue the analogy, an insurance policy that reduces your claim payout (via lower bond prices) at the same time when you file your claim (when stock prices have dropped) is rather self-defeating.

In just two months, investors turned from expecting that recession was imminent to believing that no recession is probable. We remain skeptical that Jay Powell will ultimately manage to stick a “soft landing.” But even if he does manage to pull off the feat, markets are already pricing it in. Consequently, we remain neutral on risk allocations.

Please reach out to us if you’d like to discuss capital markets or your personal financial plan.

Teancum D. Light, JD, CPA, CFP® President 717.985.8711 |

James K. Adams III, CFA, CFP® Chief Investment Officer 717.985.8713 |

Disclosures: This material is for informational purposes only and is not rendering or offering to render personalized investment advice or financial planning. This is neither a solicitation nor a recommendation to purchase or sell an investment and should not be relied upon as such. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law or any other matters that affect you or your business. Although Lighthouse Wealth Management has made every reasonable effort to ensure that the information provided is accurate, Lighthouse Wealth Management makes no warranties, expressed or implied, on the information provided. The reader assumes all responsibility for the use of such information.