Lighthouse Wealth Management uses Monte Carlo simulations to project what could potentially happen when a set of controllable assumptions—including savings, spending, retirement date and asset allocation—encounters a wide array of possible market returns. One of the advantages of Monte Carlo simulations is its consideration of the risks of a stock market crash or a low-interest-rate environment. This information can be valuable for risk assessment and management.

How Should an Investor Approach the Retirement Planning Process?

While you can affect your financial life through a regular savings program, setting an asset allocation, rebalancing your portfolio or setting your retirement date, you can never entirely control the outcome. Taxes, inflation, longevity, interest rates and stock returns are all major drivers of portfolio values, although they are not set by investors themselves.

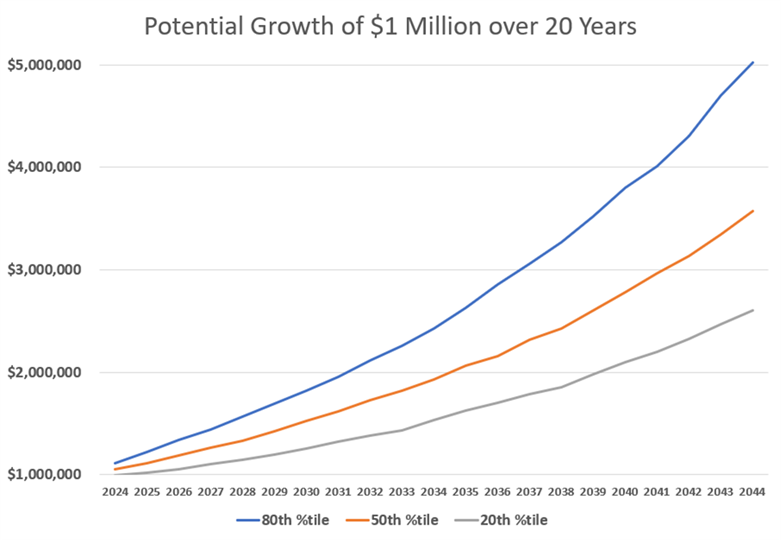

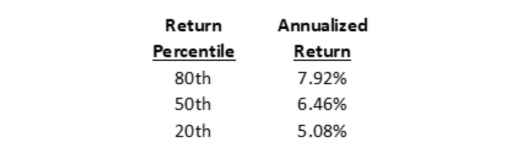

A long-term base case return for stocks and bonds may be 10% and 4%, respectively. Accordingly, a portfolio that is 50% bonds and 50% stocks would be expected to earn 7% over the long term. However, in any given year, that return could vary drastically.

Over the long term, very low return years are largely offset by exceptionally high return years. However, compounding effects can result in a large dispersion for investment account balances. Relying on historical data and assumptions provided by Lighthouse Wealth Management, the Monte Carlo simulation generates 1,000 possible returns for an investment horizon.

Consider how the value of a $1,000,000 Roth IRA, equally divided between stocks and bonds, could grow over the next 20 years.

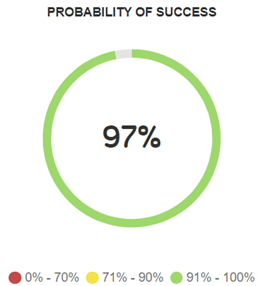

As the set of controllable assumptions are factored against the potential array of market returns, the simulation generates a “probability of success.” This probability score corresponds to the return percentile that enables the investor to meet all of their goals – e.g., an 80% probability of success means that all retirement and spending goals will be met, even if the portfolio returns are only at the 20th return percentile of the 1,000 simulations (5.08% in the above illustration).

Creating Robust Financial Plans

At Lighthouse Wealth Management, we work with our clients to draft a reasonable base case of controllable assumptions. We then stress-test our simulations for contingencies like unanticipated spending, higher-than-expected longevity and elevated long-term inflation. Passing these stress tests with a high probability of success implies that our clients’ goals are very likely to be attained, even if markets don’t make it particularly easy along the way.

If you would like Lighthouse Wealth Management to run a Monte Carlo simulation to provide a financial plan projection for you, please contact us.