Download a PDF copy of the Lighthouse Wealth Management: Outlook- July 2023

Financial Market Review

After posting a 7.5% return in Q1, the S&P 500 Index had another blowout quarter, gaining 8.7%. Once again, the “Magnificent Seven” in the index—Apple, Microsoft, Amazon, NVIDIA, Meta, Alphabet and Tesla—drove the returns. Year to date, more than 85% of gains in the S&P 500 can be attributed to those seven stocks. Without their contribution, the index would be nearly flat in 2023.

Those seven stocks generated tremendous returns in the Communications (12.5%), Technology (15.4%) and Consumer Discretionary (13.8%) sectors. Only two sectors posted negative numbers: Utilities and Energy were down 2.6% and 1.1%, respectively.

Much of the stock market rally was driven by a positive gross domestic product (GDP) revision, earnings that were “less bad” than feared and hopes that productivity gains from artificial intelligence (AI) would substantially boost earnings going forward. (FactSet noted that more than 20% of S&P 500 companies cited “AI” during their quarterly earnings calls.) AI hype notwithstanding, earnings for the S&P 500 were down 2.1% versus a year ago, with Information Technology sector earnings down 9.8%.

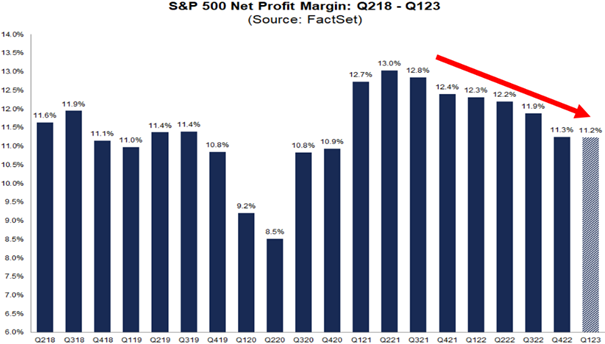

Despite strong nominal growth that continued into the start of 2023, corporate margins are narrowing as a tight labor market has enabled workers to recapture more of the economic pie. Decreasing inflation rates have also constrained companies’ ability to push higher prices onto consumers.

Source: FactSet

Although large growth companies were the star performers in Q2, United States stocks were up in all categories. Small-cap and large-cap value companies lagged their growth counterparts by 4%, while mid-cap value lagged mid-cap growth stocks by 2.5%. Developed international stocks gained 2–3% in the second quarter, while emerging markets returned about 1% in U.S. dollar terms.

Bond results were mixed during the second quarter. Treasury and mortgage bond prices dropped as yields rose, pushing the Bloomberg Aggregate Bond Index down by 0.9%. However, the higher risk appetite for stocks helped junk bonds and bank loans to generate positive returns in the 1–2% range.

Higher interest rates also weighed on commodity prices. The Bloomberg Commodity Index lost 3.8% in the quarter, as gold and silver dropped 2.7% and 5.6%, respectively.

Economic Conditions

Real GDP increased at an annual rate of 2.0% in Q1 2023, up from a previous estimate of 1.3%. The Atlanta Fed is currently projecting Q2 GDP of 1.9%.

Headline inflation continues to recede. On a year-over-year basis, the Consumer Price Index (CPI) was up 3.0% in June, the smallest 12-month increase since March of 2021. Core price changes remain elevated, however. Core CPI rose 4.8% after increasing 5.3% in May. While the direction is encouraging, the core number remains well above the Fed’s 2.0% target.

The Federal Open Market Committee (FOMC) elected to keep short-term interest rates steady in June, after a string of 10 consecutive rate hikes since March of 2022. According to the meeting minutes, nearly all FOMC officials expect more rate increases this year. Fed Chairman Jay Powell said that he wouldn’t take hiking interest rates at two consecutive policy meetings “off the table,” while noting that he doesn’t see core inflation falling below 2% this year or next. Markets are currently pricing a 97% probability that the Fed will hike an additional 0.25% at its July meeting.

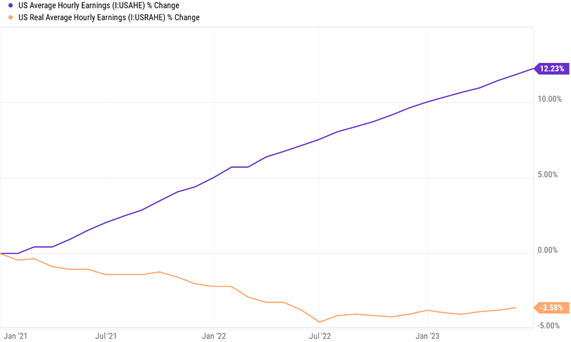

While it has generally benefited stock and real estate prices, inflation has indeed taken a toll on American workers in recent years. While nominal wages are up by more than 12% since January of 2021, real (i.e., inflation-adjusted) hourly earnings are down by 3.6% for American workers in that time period.

Source: YCharts.

Other data points to inflation’s deleterious effects on U.S. households. A Federal Reserve report found that 64% of Americans have switched to cheaper versions of products to make ends meet. Costco’s Chief Financial Officer recently observed that customers have been increasingly opting for pork and chicken in lieu of beef, and that big ticket purchases such as televisions and refrigerators have declined. He noted that he’s seen these trends previously whenever the U.S. entered a recession.

Although the headline national unemployment rate of 3.6% would appear to signify that workers have gained a firm upper hand over their employers, the dynamic is a bit more complicated. The “quits rate” (the number of resignations as a share of total non-farm employment) has been falling since last March and is now approaching pre-pandemic levels. Two other metrics also signify falling labor demand: temporary hiring has been decreasing, as have the number of hours worked by temporary employees.

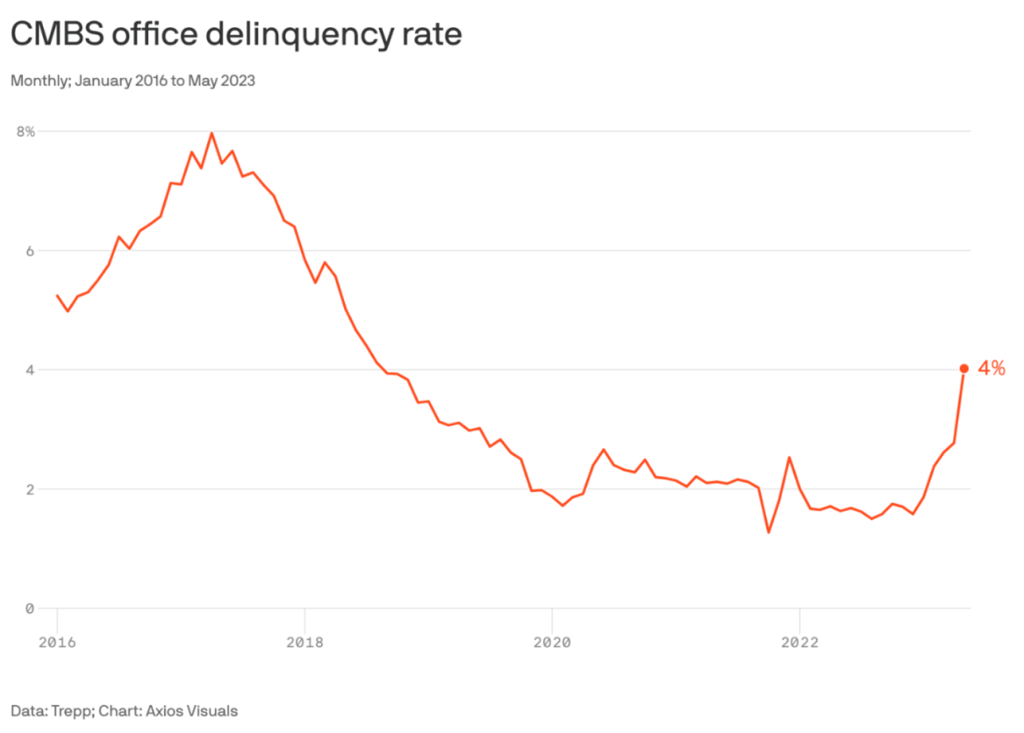

As we pointed out in our Q1 newsletter, the recent contraction in commercial bank credit is likely to prove a material economic headwind over the next 12 months. Not only are banks tightening lending standards for new loans, but it now appears that the long-anticipated problem loans in the commercial office sector are finally starting to materialize.

The delinquency rate of Commercial Mortgage-Backed Securities (CMBS) backed by office properties jumped to 4.5% by loan balance in June, up from 1.6% in December of 2022. Trepp, which tracks and analyses CMBS, notes that this is the fastest six-month spike in office delinquency rates since it began tracking the data in 2020 (that includes the Global Financial Crisis of 2008-2009.)

Source: YCharts.

Asset Class & Sector Survey

The magnitude of the recent stock market rally has made it easy to forget that we are only four months removed from the 2nd and 3rd largest bank collapses in American history, and a potential cascade of regional bank runs. While we appreciate that better-than-expected Q1 GDP numbers and some favorable tech earnings have generated euphoria, the stock market response appears rather overblown.

Only three of the “Magnificent Seven” companies—Microsoft, Amazon and NVIDIA—posted higher year-over-year earnings. In contrast, Google, Apple, Tesla and Meta all posted first-quarter earnings declines. The results may not have been as bad as analysts had been expecting, but we see little reason for elevated historical valuations.

Q1 2023 marked the second straight quarter in which the S&P 500 reported an earnings decrease, and even those anemic results likely reflected some “massaged” numbers. As The Wall Street Journal noted in a June 1st article, first quarter earnings reflected an aberrant level of adjustments to make them appear better than they otherwise would have.

According to FactSet, analysts are projecting another year-over-year earnings decline for Q2 (7.2%), before rebounding by 1.0% and 8.4%, respectively, in the third and fourth quarters. Although the much-vaunted potential of AI will undoubtedly raise corporate productivity in coming years, it seems quite unlikely that it will manage to extricate earnings from the headwinds of tightening corporate credit conditions and a shrinking money supply.

To the latter point: the U.S. money supply (as measured by M2) has fallen 4.8% from its all-time high set last summer, marking its first-ever decline since the Great Depression. Although economic circumstances aren’t nearly as severe today as in the 1930s, a shrinking money supply is nonetheless a disinflationary turn of events. This development has a rather obvious implication for the stock market: it’s difficult to generate bigger earnings when there’s literally less money around to be earned.

Higher stock prices amid mild decreases in corporate earnings would be more understandable if there were some attendant decrease in interest rates—but that isn’t happening, either. In fact, the 10-year Treasury yield rose above 4% for the first time since March, with real (inflation-adjusted) yields hitting their highest levels since 2009.

As we have noted in a previous newsletter, we believe that the elevated levels of federal debt make a 4% or more cost of financing intolerable for the Treasury over the long term. Consequently, a 4% yield on the 10-year Treasury note is a meaningful buy signal for intermediate-term bonds. With average yields to maturity of 5.7%, we recently found investment-grade corporate bonds too good to resist.

Should the much-anticipated recession finally arrive later this year (or in early 2024), the consequent decline in interest rates should provide a nice benefit for intermediate-term bonds. In the interim, we’re happy to earn 4% more than what the S&P 500 is currently paying out in dividends.

Please reach out to us if you’d like to discuss capital markets or your personal financial plan.

Teancum D. Light, JD, CPA, CFP®

President

tlight@lighthousewealth.com

Chief Investment Officer

jadams@lighthousewealth.com

Disclosures: This material is for informational purposes only and is not rendering or offering to render personalized investment advice or financial planning. This is neither a solicitation nor a recommendation to purchase or sell an investment and should not be relied upon as such. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law or any other matters that affect you or your business. Although Lighthouse Wealth Management has made every reasonable effort to ensure that the information provided is accurate, Lighthouse Wealth Management makes no warranties, expressed or implied, on the information provided. The reader assumes all responsibility for the use of such information.