Download a PDF copy of the Lighthouse Wealth Outlook here: Lighthouse Wealth Outlook – July 2021

ECONOMIC CONDITIONS

U.S. Gross Domestic Product (GDP) was up 6.4% in the first quarter of 2021, a considerable spike from the 4.3% in the fourth quarter of last year[1]. While second quarter numbers are still pending, the Atlanta Federal Reserve GDPNow model estimates GDP growth of 7.8% on a seasonally adjusted basis.[2]

For all of 2021, the Federal Reserve is projecting real GDP growth of 7.0% in 2021, up from its previous forecast of 6.5% in March.[3] The International Monetary Fund (IMF) is likewise forecasting 7.0% annual growth.[4] The predictions assume that much of President Biden’s proposed infrastructure and social spending plans will be realized.

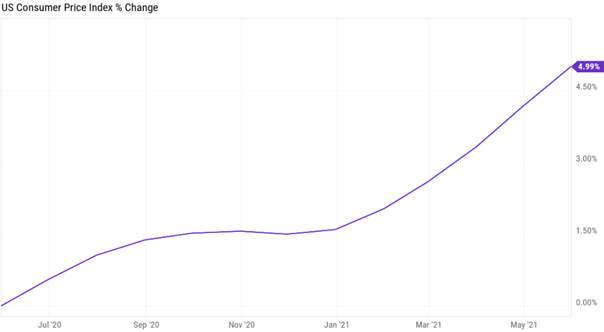

The Consumer Price Index (CPI) rose 5% year over year in May, the fastest pace since August 2008.[5] “Core CPI,” which excludes food and energy prices, was 3.8% higher—its largest spike since 1992.[6] Most of the sharp price rises were in consumer discretionary sectors such as furniture, apparel, hotels, air fare, and used cars.

Source: YCharts. Retrieved July 10, 2021.

The price increases are the result of the massive build-up in the money supply during lockdowns now finding its way into the economy. As production struggles to keep up with demand, companies are passing on the higher costs of both raw materials and labor. Wages have risen briskly as companies are experiencing difficulty filling open positions, despite nine million Americans who are seeking employment.[7]

Some of the labor shortage is likely due to the extended unemployment benefits and stimulus payments. However, there are also “structural” elements to unemployment, due to increased preferences for remote work, and mismatches between the type and location of labor supply and demand.

Even though the recent inflation reading came in above expectations, the “breakeven inflation” rate on five-year Treasury bonds versus TIPS actually decreased from 2.54% to 2.47% over the quarter.[8] Minutes from the Federal Reserve’s June meeting convey a similar theme. The Fed sees inflation running to 3.4% this year, a percent above its previous estimate. However, it believes that the annual pace will revert to the mid-2% range by 2022.[9]

FINANCIAL MARKET CONDITIONS

A slim majority of the Federal Open Market Committee (FOMC) members expect to keep interest rates at zero through 2022.[10] The majority is projecting at least two rate hikes in 2023. Chairman Jerome Powell also indicated that the committee had recently held its first discussions about reducing the $120 billion monthly pace of bond purchases.[11]

Despite no material decrease in anticipated inflation, Treasuries still managed to perform well in the second quarter as the “real yield” on the 10-year note decreased by 0.25%.[12] A general rally in risk assets likewise helped corporate bonds. These two effects enabled the benchmark Barclays Aggregate Index to post a very respectable 1.83% total return.[13]

Relative to comparable maturity Treasury bonds, most of the bond market’s “risk sectors” have never offered less yield over the past 15 years. Municipal bonds, investment-grade corporate bonds, asset-backed securities, and high-yield corporate bonds are all trading at their lowest yield spreads since 2006. Only mortgage-backed bonds and emerging-market debt are offering spreads close to their long-run averages.[14]

Stocks had another blowout quarter, with the S&P 500 Index up nearly 8.6%. All industry sectors generated a positive return, with Technology (13.2%) and Real Estate (12.5%) leading the way. After lagging value in the first quarter, growth stocks posted a solid rebound. Large- and mid-cap growth indexes were up 13.2% and 13.0%, respectively, in the quarter. International stocks also fared well, as broad developed and emerging market indexes returned to the 5% range.[15]

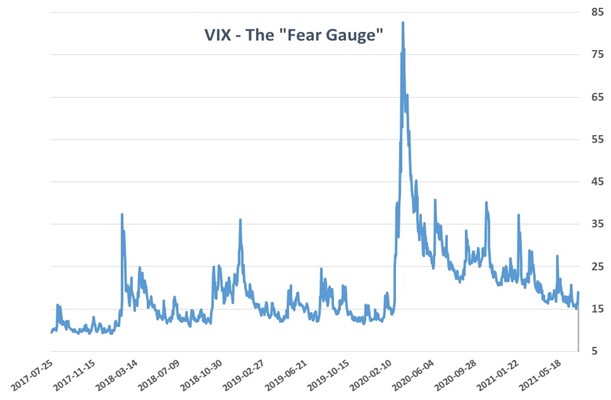

The S&P 500 Index is now up 15.2% through June 30, with five consecutive monthly gains, and the climb has been almost entirely painless. That is, the Index hasn’t had a 5% correction (based on closing prices) since the end of October.[16] In another sign of diminishing apprehension, the CBOE Volatility Index (VIX), sometimes referred to as a “fear gauge,” has retreated to pre-COVID levels.

VIX

Source: YCharts

PORTFOLIO POSITIONING

Given the stock market’s virtually uninterrupted ascent this year, there is a strong temptation to conclude that euphoria is the primary driver. Nevertheless, the 12-month forward price-to-earnings ratio is 22x—the same level as it was in December 2020. This indicates that the 2021 rally is entirely due to higher profit expectations, rather than an increase in valuation multiples.[17]

According to Refinitiv IBES data, analysts now expect earnings growth of 66% for companies in the S&P 500 Index in the second quarter, up from a forecast of 54% growth at the end of March.[18] The size of the upward revision is rather surprising, until one considers the 33% expansion in the U.S. money supply over the preceding 18 months.[19]

While neither stocks, bonds, nor real estate offer very compelling value at this point, stocks can at least be said to be relatively cheap versus bonds. Furthermore, they provide a meaningful inflation hedge, as previous monetary expansion now translates into higher corporate profits. At present valuations, we would strongly caution against adding longer-maturity bonds or bonds with elevated credit risk.

If you have any thoughts or questions regarding capital market conditions and/or financial planning, please contact me.

Disclosures: This material is for informational purposes only and is not rendering or offering to render personalized investment advice or financial planning. This is neither a solicitation nor a recommendation to purchase or sell an investment and should not be relied upon as such. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law or any other matters that affect you or your business. Although Lighthouse Wealth has made every reasonable effort to ensure that the information provided is accurate, Lighthouse Wealth makes no warranties, expressed or implied, on the information provided. The reader assumes all responsibility for the use of such information.

[1] www.atlantafed.org/cqer/research/gdpnow. Retrieved July 10, 2021.

[2] Ibid

[3] www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20210616.pdf

[4] www.reuters.com/business/imf-raises-us-2021-growth-forecast-7-fastest-pace-generation-2021-07-01/

[5] www.wsj.com/articles/us-inflation-consumer-price-index-may-2021-11623288303

[6] Ibid

[7] www.wsj.com/articles/job-openings-are-at-record-highs-why-arent-unemployed-americans-filling-them-11625823021

[8] Source: YCharts. Retrieved July 10, 2021.

[9] www.cnbc.com/2021/06/16/the-federal-reserve-now-forecasts-at-least-two-rate-hikes-by-the-end-of-2023.html

[10] www.cnbc.com/2021/07/07/federal-reserve-releases-minutes-of-its-june-15-16-meeting.html

[11] Ibid

[12] fred.stlouisfed.org/series/DFII10. Retrieved July 10, 2021.

[13] YCharts. Retrieved July 10, 2021.

[14] JP Morgan Guide to the Markets. Retrieved June 30, 2021.

[15] YCharts. Retrieved July 10, 2021.

[16] Ibid

[17] JP Morgan Guide to the Markets. Retrieved June 30, 2021.

[18] www.reuters.com/business/dow-sp-futures-rise-banks-energy-stocks-rebound-2021-07-09

[19] YCharts. Retrieved July 10, 2021.